Printing Your Return and Individual Forms 2020-2026

Eligibility Criteria for the Texas Ag Timber Tax Exemption

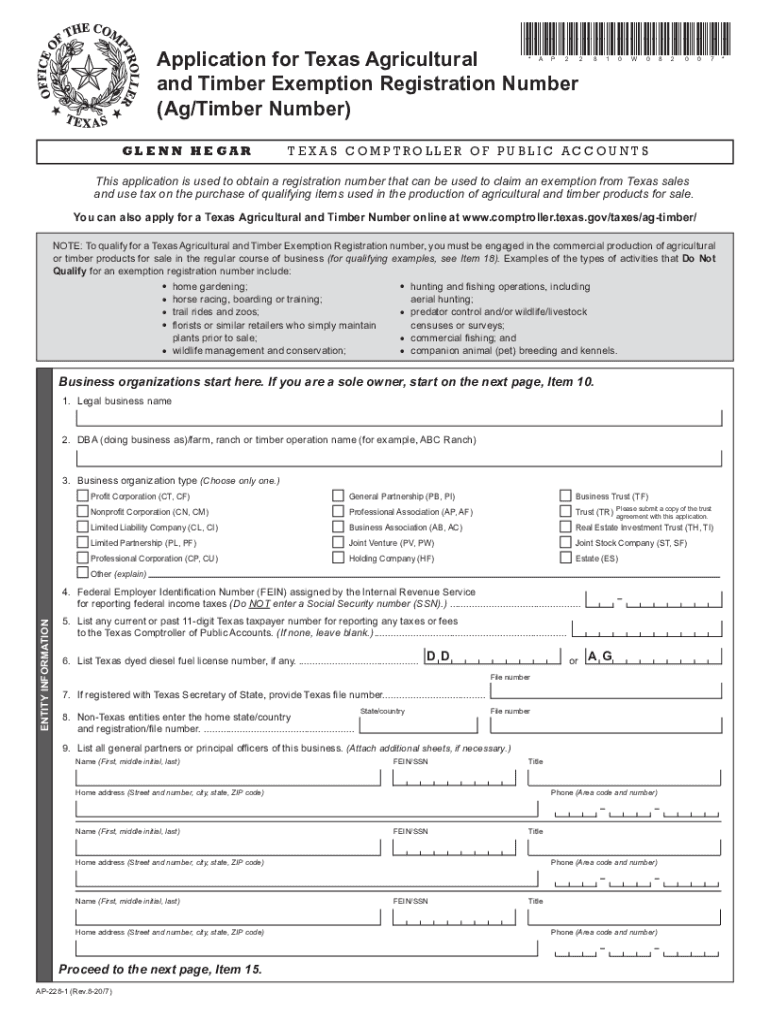

The Texas Ag Timber Tax Exemption is designed for landowners engaged in agricultural or timber production. To qualify, applicants must meet specific criteria, including:

- Ownership of at least five acres of land dedicated to agricultural or timber production.

- Active participation in the management and operation of the land.

- Compliance with local and state regulations regarding land use.

- Submission of the appropriate ag exemption form for Texas to the local appraisal district.

Landowners should ensure that their operations align with the state's definition of agricultural or timber production to avoid potential disqualification.

Application Process and Approval Time for the Texas Ag Timber Tax Exemption

Applying for the Texas Ag Timber Tax Exemption involves several steps. First, landowners must complete the ag timber application accurately. This includes providing details about the land, its use, and any relevant agricultural or timber activities. Once the application is complete, it should be submitted to the local appraisal district.

The approval time can vary, but applicants typically receive a response within thirty to sixty days. It is advisable to apply early, especially if the exemption is needed for a specific tax year.

Required Documents for the Texas Ag Timber Tax Exemption

When applying for the Texas Ag Timber Tax Exemption, landowners must prepare specific documents to support their application. These may include:

- Proof of land ownership, such as a deed or title.

- Documentation demonstrating agricultural or timber production activities, including receipts or contracts.

- A completed ag exemption form for Texas, detailing the land's use and management.

Having these documents ready can streamline the application process and improve the chances of approval.

Legal Use of the Texas Ag Timber Tax Exemption

The Texas Ag Timber Tax Exemption is legally binding once approved. It allows qualifying landowners to benefit from reduced property taxes based on the agricultural or timber use of their land. However, it is essential for landowners to maintain compliance with the terms of the exemption.

Failure to adhere to the regulations can lead to penalties, including the potential loss of the exemption and back taxes owed. Regular audits by local appraisal districts may occur to ensure compliance.

Filing Deadlines for the Texas Ag Timber Tax Exemption

Timely submission of the ag timber application is crucial for obtaining the Texas Ag Timber Tax Exemption. The filing deadline is typically set for April first of the tax year for which the exemption is sought. Landowners should be aware of this date to ensure they do not miss the opportunity for tax relief.

In some cases, late applications may be accepted, but this can result in complications and may not guarantee approval for the current tax year.

Form Submission Methods for the Texas Ag Timber Tax Exemption

Landowners can submit their Texas Ag Timber Tax Exemption application through various methods. The most common submission methods include:

- Online submission via the local appraisal district's website, if available.

- Mailing a printed copy of the application to the local appraisal district office.

- In-person submission at the local appraisal district office.

Each method has its advantages, and landowners should choose the one that best suits their needs and ensures timely processing of their application.

Quick guide on how to complete printing your return and individual forms

Complete Printing Your Return And Individual Forms effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents quickly without delays. Handle Printing Your Return And Individual Forms on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Printing Your Return And Individual Forms with ease

- Obtain Printing Your Return And Individual Forms and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Identify important sections of the documents or obscure sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Printing Your Return And Individual Forms and ensure seamless communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printing your return and individual forms

Create this form in 5 minutes!

How to create an eSignature for the printing your return and individual forms

The best way to generate an eSignature for a PDF in the online mode

The best way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to create an eSignature right from your smart phone

How to create an eSignature for a PDF on iOS devices

The way to create an eSignature for a PDF on Android OS

People also ask

-

What is the Texas ag timber tax exemption?

The Texas ag timber tax exemption is a financial incentive provided to landowners who manage their land for the production of timber. This exemption helps reduce property taxes for those engaged in agricultural production, specifically focusing on timber harvesting and management.

-

How do I qualify for the Texas ag timber tax exemption?

To qualify for the Texas ag timber tax exemption, landowners must demonstrate that their land is primarily used for timber production and meet specific criteria established by the Texas Comptroller's office. This typically involves providing documentation of the land's management practices and timber sales.

-

What documents do I need to apply for the Texas ag timber tax exemption?

When applying for the Texas ag timber tax exemption, you will need to provide proof of your land's use for timber production, such as management plans, sales records, and any corresponding tax forms. This documentation helps establish eligibility and ensures compliance with state regulations.

-

Can I eSign documents related to the Texas ag timber tax exemption?

Yes, you can easily eSign documents related to the Texas ag timber tax exemption using airSlate SignNow. Our platform allows you to securely sign and manage all necessary paperwork online, streamlining the application process and ensuring timely submissions.

-

What are the benefits of using airSlate SignNow for tax exemption applications?

Using airSlate SignNow for your Texas ag timber tax exemption applications can signNowly enhance your workflow. Our easy-to-use interface allows for quick document preparation and eSigning, reducing turnaround times and ensuring that you meet critical deadlines efficiently.

-

Is airSlate SignNow cost-effective for managing tax exemption documents?

Yes, airSlate SignNow is a cost-effective solution for managing your Texas ag timber tax exemption documents. With flexible pricing plans, you can choose the option that best fits your needs, allowing you to save money while efficiently handling your paperwork.

-

Are there integration options available with airSlate SignNow for tax management?

Absolutely! airSlate SignNow offers integration options with various accounting and tax management software, making it easier to manage your Texas ag timber tax exemption documentation alongside your financial records. This can streamline your operations and enhance data accuracy.

Get more for Printing Your Return And Individual Forms

Find out other Printing Your Return And Individual Forms

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document